http://ottawacitizen.com/news/local-news/how-15000-vanished-from-an-ottawa-school-councils-bank-account-and-stayed-secret

For nearly 2 1/2 years, members of the parent council at Leslie Park Public School say, they have felt as though they needed to keep a secret.

At least $14,839.41 vanished from the school’s fundraising account, according to a council investigation. The parents at the school haven’t been told of the full extent of the loss. The parent council accuses the Ottawa-Carleton District School Board of repeatedly preventing them from detailing to parents what happened at the small school of 115 students in a residential area near Greenbank and Baseline roads.

The board says it couldn’t reveal the details about the missing funds since the matter was under police investigation. Since no charges were laid, the investigation was “not a matter of public record” and there were limitations on what it could reveal, the board said, although it has since agreed to reimburse the school council for the entire amount.

How thousands of dollars went missing, who took it, and why parents were kept in the dark has been revealed through documents obtained by the Citizen and through interviews with members of the school’s parent council.

In September 2014, Dave Wright went to the bank to determine how much money was in the Leslie Park Public School parent council’s bank account, which was used to keep the proceeds of fundraisers such as pizza days, cake walks and movie nights.

Wright, the school’s newly elected parent council treasurer, was checking to see how much money was left in the account from the year before. It was one of his first acts as treasurer — a role he’d taken over from Corinne Reynolds who had left the school at the end of the previous academic year.

The numbers didn’t make sense to Wright. He said he felt butterflies in his stomach.

The account — which had a balance of $10,616.81 in January 2011, the last time a financial report had been prepared by the council — was overdrawn by $121.94. More than $6,500 from school council fundraisers since that time also wasn’t accounted for.

The money had vanished.

“I thought ‘I’m just going to report this and the police are going to come in, the cop cars are going to pull up on the lawn, and this is what is going to happen,'” Wright told the Citizen. “I went immediately to the principal and I went into his office and closed the door and said ‘It’s bad.'”

After Wright told the principal, the principal contacted the Ottawa-Carleton District School Board. The board’s advice was for the council to make an official complaint to police, which they did.

What followed was a multi-year investigation and the painstaking tracking of the spending in the account by the council.

It was a challenge made more difficult because there were no financial reports prepared by the council for three years between 2011 and 2014, a direct violation of OCDSB policies, according to Wright.

“All we had was the numbers, trying to figure out where each nickel and dime was going,” Wright said.

Bank records obtained by the council showed unusual withdrawals beginning in July 2012.

The first odd withdrawal was a $150 cheque Reynolds — who acted as both the school’s former treasurer and council chair — had written to herself.

The cheque was supposedly for Walmart gift cards. Later there was a $100 cheque issued to her now former husband. Then $200.59 was supposedly spent on a camera.

There was another $300 cheque supposedly for Walmart gift cards, a $705 cheque for the rights to show movies at school that were never actually purchased and $900 for the supposed purchase of a table. Some of the cheques were made out to herself using both her married and maiden names, a review of the bank records revealed.

In November 2012, a second camera was supposedly purchased, this time for $300.

“I’ve never seen them,” Wright said.

The bank account required two signatures on every cheque, but the person who previously co-signed the cheques had left the school when her children graduated. When Wright went to the bank, that woman’s name was still on the account. It appears no one from the bank ever checked to see if there were two signatures — that was the responsibility of the account holder, the council was told.

While some of the transactions in the account matched purchases made by council, the majority of the transactions did not, Wright said.

In total, there were 319 transactions in the school council account between January 2011 and September 2014, including 196 cheques. There were 113 cheques that only had a single signature; 13 of them bounced because of insufficient funds, according to the council investigation.

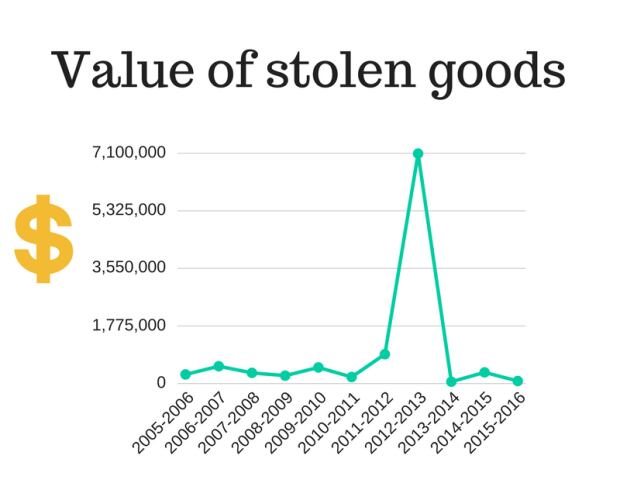

Wright said the handling of the school council’s finances seemed to violate several school board policies regarding school councils and fundraising. It was even more concerning as it continued after a massive fraud was uncovered at the Rockcliffe Park Public School council in February 2012.

But unlike the school in Rockcliffe, where large sums of money were owed to creditors, Leslie Park owed only a few hundred dollars to a pizza supplier, making the loss of money easier to suppress from parents and the public, Wright said.

In a written statement to the Citizen, the school board’s executive officer, Michele Giroux, said the school council opted to maintain a bank account at a separate financial institution than the school, and neither the principal nor the school district had any access to or oversight of the account. However, board policy that came into effect in September 2013 requires financial reporting at school council meetings. That wasn’t being done at Leslie Park, according to Wright.

The board said policy has since changed so that a school council must provide signing authority to the treasurer and two other officers. Other policies surrounding financial management were changed in 2013 and 2014, Giroux said, although it wasn’t clear how the mismanagement at Leslie Park was able to continue until September 2014.

The financial investigation report undertaken by the parent council took two years to compile and during that time, the work being done by the council was mostly kept secret.

At first, council members thought they had to let police conduct their investigation. But as the weeks dragged into months and then years, they became more concerned about the silence.

Parents at the school still hadn’t been told about the missing money. The council says the school board stymied them whenever they asked to go public.

By February 2016, the board provided council with $2,000 to “offset any loss that may have otherwise been determined had there been sufficient information to quantify that a financial loss was actually incurred.”

The council responded in a letter to the board that they felt transparency to the school parent community was essential. The council also said they had begun preparing a media release on their own and asked for the board’s assistance.

“Full disclosure of what happened will bring closure to this ongoing saga and as well assist in an effort to recoup our actual losses,” the letter said.

Instead the school authorized a much more sanitized version for the parents in the school’s spring newsletter. Under the title “School Council Transparency”, the newsletter advised parents only of “discrepancies” in the school council account balance and transactions “that could not be fully accounted for.” There was no mention of a specific amount, although it did make an admission that the school hadn’t been in compliance with OCDSB policy.

It was around this time, in April 2016, that the school council learned from the board that police had met with Reynolds.

In an email obtained by the Citizen and sent to the school board superintendent of instruction, Frank Wiley, Ottawa police Const. Michael Dosdall wrote that Reynolds “quickly admitted to wrongdoing” and “wanted to make things right.” Dosdall wrote that Reynolds couldn’t remember “what all happened” but seemed confident that she could pay back as much as $5,000 in restitution.

Dosdall warned that once any money is paid back it is a civil agreement, and police wouldn’t be able to charge anyone criminally. However, proceeding that way would ensure the school recovered some of the money. Attempts to reach Dosdall by the Citizen were unsuccessful.

When the Citizen approached Reynolds earlier this week, she said she had agreed to pay back $5,000 and that she had written a letter of apology. She disputed that the amount missing was as high as council claimed, however.

She has not been criminally charged, and the board said the police investigation is finished.

The board wouldn’t say whether they had recovered any of the missing funds.

The amount allegedly recovered from Reynolds is disappointing to council, whose members thought they had an agreement with the board that the amount that would be paid back would be twice that much. One email in June 2016 from Wiley to council members indicated that the board had proposed a $3,500 settlement.

In an August 2016 letter to the school board, the council members said that agreement for anything less than $10,000 was unacceptable. The letter also again demanded that the school community be provided the details of what happened.

“Since the OCDSB and our council have always agreed that we need to promote financial responsibility in our schools, we simply do not understand why you would not want to hold someone fully responsible in this case,” they wrote.

When still nothing happened by November 2016, Wright publicly presented a report on the full scope of council’s investigation into the missing funds.

That meeting was well attended by council members, but only a handful of other parents. Of the 17 parents present, only six weren’t already on parent council, according to a draft copy of the meeting minutes.

The Citizen contacted Wright and the council after receiving a copy of that report in late January.

It was also during that meeting that the council presented a letter they wanted to send to the parents. That letter outlined the details of what had happened as well as a link to the financial report. To date, the council has not received approval from the board to send the letter to parents or to post it on the school’s website or Facebook page.

The council alleges that the school’s principal also recommended changes to the meeting’s minutes, which must be publicly posted on the school’s website. The first draft version of the minutes indicated that Wright had presented a report on the missing money, including the approximate amount. According to council members, those references were removed by the principal, along with a notation about how council wanted to advise the parents about what had happened in subsequent copies.

“I do not have any detailed knowledge of this issue, but can say generally that the school council is the approval authority for their minutes and the minutes should reflect the decisions made at the meeting,” Giroux said in her statement to the Citizen.

At the January school council meeting, council co-chair Karen Adelberg was pulled aside shortly before the meeting and was told by the board that the school would get all its money back. She made the announcement during the meeting.

However, Adelberg said the council wasn’t told if it is money that was repaid by the person who took it, or if it’s money being paid out of the school board’s budget.

“This whole thing wasn’t about trying to squeeze the board for money,” said Wright. “We wanted the person responsible to take accountability for it.”

Leslie Park Public School is one of eight Ottawa schools the school board recommended for closure in a report last year.